The man on the other end wanted to sell his small Iowa farm. And, of course, he wanted to sell it for a good profit. And then he wanted to use that money to buy another, larger farm.

Good idea!

But he didn’t want to pay any capital gains taxes on the land that he was selling.

Another good idea, right? I mean who does want to pay taxes?

Of course, he may have to pay taxes. We all do. Unless that is, we employ a process called the 1031-tax deferred exchange.

What is a 1031-tax deferred exchange? (or just 1031-tax exchange)

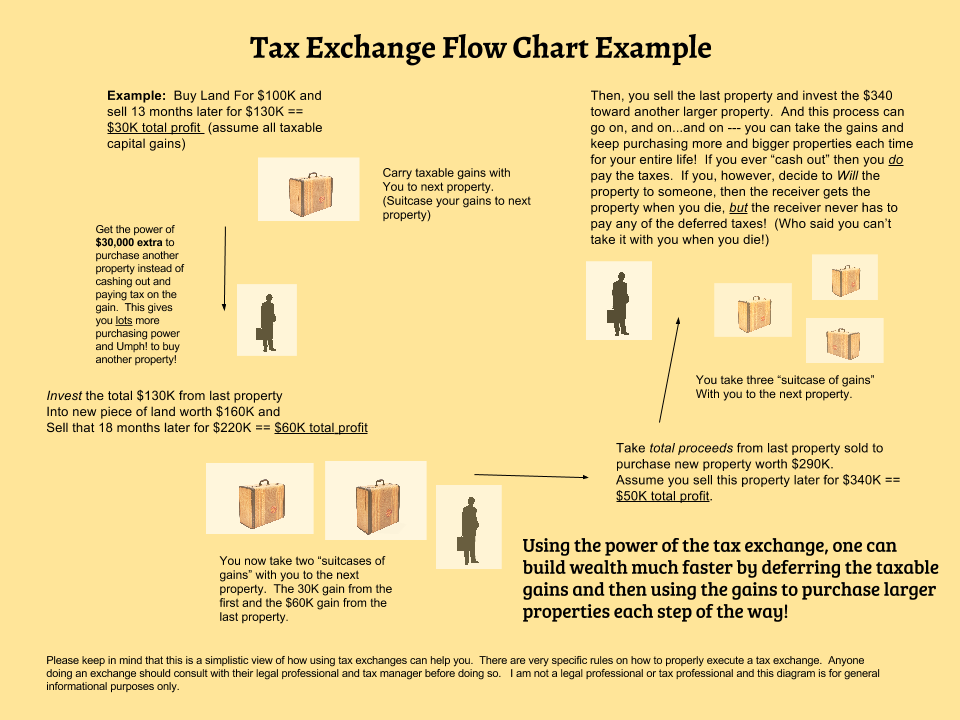

By using 1031 tax exchange, a person can “defer” the gains on the sale of real property into another piece of real property.

Any real property into any other real property. This means you can exchange a farm for another farm, a home, or maybe a commercial building, if desired, for example.

Say for instance that you purchased a 40- Iowa parcel of land ten years ago for $60,000. And, suppose, that right now you have a buyer that is ready to hand over $90,000 for that parcel of Iowa land.

What happens to the $30,000 gain?

In a normal transaction that gain is taxable and in this case would be considered a long-term capital gain (since it was held for at least one year). But by employing the process of the 1031- tax exchange, you would not have to pay any gain on that $30,000 (at least, not at the time of the sale).

The $30,000 gain would simply be rolled into the purchase price of another, usually larger, and more expensive property. Perhaps you found an 80-acre parcel down the road for $160,000 that you’d like to buy, for instance.

Well, now, if you carry out a 1031-tax exchange, you have most are all of the down payment necessary to purchase that 80-acre farm!

The good part is that you can use the full power of the gain instead of getting slammed with paying taxes on it.

This lets you build up to bigger and larger parcels of land much, much, faster and with less out-of-pocket expense than you ever could otherwise!

So, that entire capital gain, usually, transfers into another “replacement” property right after you sell. You don’t, normally, put any of it in your pocket but it does go right into an investment that is typically more expensive than the one you previously had. This is the basis of the process – the 1031-tax exchange process lets you carry gains with you as you step up to more expensive properties.

It’s not hard to see that doing this not only helps save you tons of tax money but it also helps you build up a bigger and healthier looking real estate portfolio over time (whether that was your goal of not).

Some people seem scared or intimated of the process or they think it is something new and “tricky”.

The 1031-tax exchange is used and has been used, by thousands of experienced real estate investors every year as a means to help create wealth and as a means to build up to bigger and better parcels of land. And it can and does do that! It is not a new or secret process.

How to go about using a 1031-tax exchange.

The first thing to realize is that doing a tax exchange, while simple in concept, is still rather complex.

There are lots of rules and stipulations that must be followed to the letter for this to work.

But, rest easy, a good real estate attorney will handle all of this for you. And you do need one if you are going to do a 1031-tax exchange.

In general, the seller of a property should establish if he/she wishes to carry out an exchange before they decide to sell.

An attorney will set up the required documents for the 1031 tax exchange process to carry out legally and accurately.

When you sell your property for a profit, you then have 45-days to find a suitable replacement property. This is usually a more expensive and, thus, often is also a larger property that you will move the capital gain of the sale of the relinquished, property into.

Once you’ve identified a replacement property, you then have 6-months to close on that property.

Again, you will want a good real estate attorney who is familiar with 1031-exchange laws to carry this out for you! (They are not hard to find via Google or the good old yellow pages!)

A neutral, third-party, intermediary actually holds the money from the gain of the relinquished property in a trust account until the closing day of the replacement property (known as a “safe harbor”).

An important component of the laws around this is that the seller of the relinquished property never really touches the profits!

Most of the time all of the profits from the sale of the relinquished property are then put right back into a replacement property.

One can keep some of the profits if they desire, but those profits would be taxable (known as “taxable boot money”). Again, the 1031-tax exchange rules are strict and the procedures must be carried out exactly as prescribed.

But don’t let that scare you, a good attorney will handle this for you!

You don’t really need to do anything yourself, as a seller, but to concentrate on selling your property. And then on finding a suitable replacement for your profits to go into.

An interesting thing to note is that you can carry on this 1031 exchange process your whole life – that is, you can buy and sell, buy and sell, buy and sell, each time making profits that roll into the next using the 1031 tax exchange process.

Each time you do this you are carrying all of the profits from one property into the next – helping you to build more and more acres of land each time you carry it out.

This sort of multiplier effect of being able to use all of the profits, instead of paying huge taxes on each sale, each time you “reload” to get more land is huge!

The 1031 tax exchange process really lets you build up allot of valuable land in the quickest and cheapest way possible. Simply put, you get a huge break each time you buy because you aren’t paying taxes on the profits of the previous sale – the profits all go straight into your new replacement property. This happens each and every time you do this – for as long as you want.

But why do they call it a 1031 deferred tax exchange if you never have to pay taxes on the land that you continue to buy?

Well, at some point, when you decide to sell your final piece of land later in life and want to take the profits with you to live the good life in Hawaii, then you would need to pay the taxes on the profits of the sale.

But maybe instead of taking the profits out of your final parcel of land and moving to Hawaii, you simply decide to “will” the assets that you acquired using the 1031 process to your heirs.

Then – when you die – your property all gets transferred to those chosen and they do not have to pay any of the taxes that you deferred along the way.

No kidding!

They would pay taxes on the property that you gave to them should they elect to sell but they do not have to pay all the back tax-deferred gains that you used to get there!

They would just be taxed on any gain from the sale of the property that is over and above the then appraised value of the property.

There you have it: a quick overview of the 1031-tax exchange process. Keep in mind that I am not an attorney and that this information is just meant as general guidance based on my understanding of the current tax code. You should always seek the representation of a qualified real estate attorney and/or other tax professional when doing a 1031-tax deferred exchange.